The Benjamin App. We’ve talked about it before. We’ve already gone in on whether the app is legit or a scam. But once you download it and start setting things up, it immediately asks to connect to your bank account and your debit card — and that’s where a lot of people pause.

Is the Benjamin App safe to connect to my bank on my phone?

That’s a completely fair question. You should never just hand over your financial info to any “cashback” app promising easy money. So let’s walk through exactly why Benjamin asks for access, how it uses that access, and how it protects your data — including how Plaid works, since Plaid is the security layer between Benjamin and your bank.

Why Does the App Need My Banking Information?

First things first: the Benjamin App is a cashback app. That’s literally the entire point. It gives you cashback when you spend money with your debit card. In order to calculate that cashback, it has to see your qualifying transactions. There’s really no way around that.

The app itself is free. Benjamin does not charge you to sign up, and it doesn’t take money out of your account. What it does need is read access — meaning it needs permission to view your purchases so it can track when you’ve earned rewards and credit you for them.

Here’s the basic flow:

- You link your checking account and your debit card.

- Benjamin tracks eligible debit card purchases and calculates cashback on them.

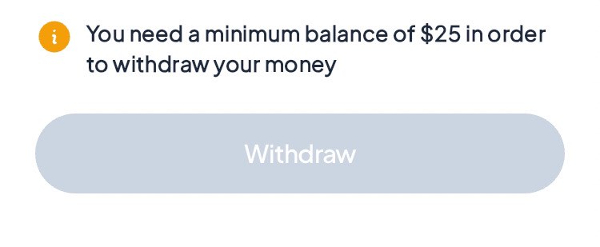

- Your cashback balance builds over time and can be withdrawn to your bank.

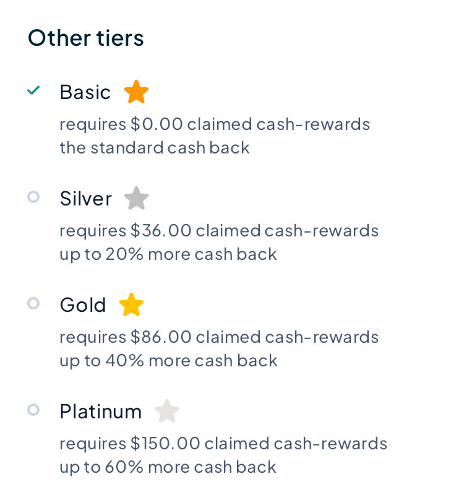

As you keep using your debit card, your cashback rate can increase, and eventually you’ll hit the highest tier the app offers. That’s how regular spending turns into extra money.

Important: Benjamin pays cashback on debit card purchases. Zelle payments, PayPal transfers, or simple bank-to-bank transfers don’t count toward cashback.

So… Is the Benjamin App Safe to Connect To?

Short answer: it’s designed to be.

When you connect your bank to the Benjamin App, you’re not just handing over your login to Benjamin directly. Benjamin uses a company called Plaid to handle the secure connection between your bank and the app. Plaid is a financial technology company that sits in the middle and securely links your bank to apps without exposing your full login details to the app itself.

Think of it like this: Plaid is the armored delivery driver. It picks up the transaction info from your bank, delivers only what Benjamin needs in order to track cashback and payout your rewards, and doesn’t hand over your username/password to Benjamin. Plaid is widely used across the finance world — we’re talking budgeting apps, investing apps, and payment apps (including big names like Venmo and other major financial services).

This setup protects you in a couple of important ways:

- Your bank login isn’t just sitting inside some random cashback app. Benjamin doesn’t store your bank credentials. Plaid handles verification instead.

- Your data is sent over encrypted, private connections. Plaid uses high-grade encryption (AES-256) and Transport Layer Security (TLS) — the same level of protection banks and payment processors rely on — to keep your account info unreadable to anyone who shouldn’t see it.

- Extra login protection is built in. Plaid uses multi-factor authentication (MFA). That means even if someone had your password somehow, they’d still need a second proof (like a code sent to you) to access your account through Plaid.

On top of that, Plaid’s entire business model depends on security. It’s a major player in financial technology, connecting apps to thousands of banks and credit unions, and it’s gone through audits and certifications to meet strict industry standards like SOC 2 and ISO 27001.

What Is Plaid & Why Is It Safe?

Plaid is basically the secure bridge between your bank and the Benjamin App. When you try to link your account in Benjamin, you’ll actually see a Plaid screen asking you to choose your bank and log in. That’s because Plaid, not Benjamin, is doing the verification.

Here’s what Plaid is doing behind the scenes and why that matters for your safety:

- Advanced Encryption: Plaid uses bank-level encryption standards like AES-256 to scramble your sensitive data so it’s unreadable to anyone who tries to intercept it. When info moves between your bank and Benjamin, Plaid also uses TLS to create a secure, private “tunnel” so your data isn’t exposed in transit.

- Secure Transfer, Not Full Access: Plaid transmits the transaction data Benjamin needs to confirm your eligible purchases and track your cashback — but Benjamin doesn’t get your full banking login and can’t just start moving money around without your authorization. Plaid’s role is to verify and share only the data you’ve agreed to share.

- Multifactor Authentication (MFA): Plaid can require extra identity checks, like codes sent to your phone, before letting an app connect to your bank. That means even if someone somehow knew your password, they still wouldn’t automatically get through.

Because Plaid is built to be the secure middle layer, you’ll see it — or something similar — any time you connect your bank account to a modern financial app. It’s extremely common tech. It’s used by huge companies across payments, budgeting, investing, and cash transfer services.

So, Should I Feel Safe Linking My Bank and Debit Card to Benjamin?

Here’s the honest answer: any time you connect your bank to any third-party app, there is some level of risk. Total zero-risk doesn’t exist online. That said, Benjamin’s setup — using Plaid to link and verify accounts — follows the same security playbook trusted by major financial apps that move real money every day.

Plaid uses strong encryption, MFA, and secure transmission standards to keep your credentials protected. It doesn’t just hand over your banking username and password to Benjamin. And Benjamin uses that connection to do what it’s supposed to do: read your eligible transactions so it can calculate your cashback and send you your money.

So yes — if your main concern is, “Can this app just drain my account?”, that’s not how this works. The app is built to track your purchases for rewards, not to pull money out every time you buy groceries. And Plaid’s entire job is making sure that connection happens in a locked-down, monitored, audited way.

Bottom line: if you’re using Benjamin because you want to earn cashback on everyday spending, linking your accounts through Plaid is a normal and expected part of how that works — and it’s designed to be secure.

Happy earning, mamas — and keep watching those transactions like the smart, financially aware queen you are.

Leave a Reply